salt tax deduction new york

You must itemize using Schedule A to claim the SALT deduction. The Supreme Court will not revive an attempt by New York and three other states to overturn the Trump-era 10000 cap on state and local tax deductions known as SALT.

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

The SALT deduction allows you to deduct your payments for property tax payments and either income or sales tax payments.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

. New Yorks SALT Workaround. The courts denial of. The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions.

The Pass-Through Entity tax allows an eligible entity to pay New York State tax. Trumps 2017 tax cut capped the previously. The SALT cap essentially resulted in a pretty large tax increase for a lot of families in the suburbs of New York City Mr.

SALT paid by the. New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline. The maximum SALT deduction is 10000 but there was no cap before 2018.

SCOTUS swats away SALT cap challenge that limits tax deductions in New York Maryland Four states had challenged the 2017 limit on deductions of state and local taxes. Nov 05 2021 at 1114 AM. Republicans created a 10000.

A pair of House Democrats have sponsored legislation that would restore the state and local tax SALT deduction for Americans who make under 400000. This consequential tax legislation available to electing pass-through entities provides a. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021.

The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021.

I am proud we are taking this issue to the Supreme Court to continue to fight on behalf of New York taxpayers Gov. 1 2021 New Yorks pass-through entity tax PTET will allow partnerships except publicly traded partnerships and entities that are treated as S corporations for New York purposes an annual election to pay income tax on behalf of its owners. This new legislation is better late than never since.

This provision is not available for publicly traded partnerships. Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro area particularly hard. With Democrats in power those homeowners are.

2 days agoMnuchin the states of New York Maryland Connecticut and New Jersey filed a lawsuit alleging that the 10000 cap on SALT deductions for federal income tax purposes violated the US. Assuming this taxpayer also owns a home in New York property taxes will consume much of the 10000 federal cap so this SALT workaround will allow the taxpayer to deduct up to 10000 of state and local taxes paid in addition to a 12000 charitable contribution instead of being limited to a 10000 deduction for the total state and local taxes paid. The United States District Court for the Southern District of New York dismissed the case after hearing the governments motion for summary judgment.

Most people do not qualify to itemize. Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that the Trump administration limited to 10000. New York State Enacts Pass-Through Entity Tax as SALT Limitation Workaround.

Starting with the 2018 tax year the maximum SALT deduction available was 10000. The limitation on the deductibility of state and local taxes SALT at 10000 was part of the Tax Cuts and Jobs Act back in 2017 and without pointing fingers it seemed to many like it may have been taking a shot at blue states that tend. Kathy Hochul D said in a news release Monday.

The pass-through entity tax represents a welcome tax planning opportunity for New York State individual taxpayers given that these taxpayers were traditionally among those with the highest average federal deductions for state and local taxes before the implementation of the SALT limitation. The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on state and local. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes.

New York Daily News. SALT Deduction Cap Stays in Place After Supreme Court Rejects New York Challenge. Avoiding the SALT Limitation New York Enacts a Pass-Through Entity Tax to Help Taxpayers Work Around the SALT Limitation.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. The SALT cap limits a persons deduction to 10000 for tax years beginning after.

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

Use Our Tax Calculators And Find Great Information About Taxes Estate Tax Property Tax Tax Deductions

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Mackay Municipal Managers Muni 360 Taxi Service Rideshare New York Life

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

First Look At The Tax Provisions Of The New York State 2021 2022 Budget Act The Cpa Journal

Cuomo Privately Calls On Business Leaders To Stay In Ny Lobby On Salt

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

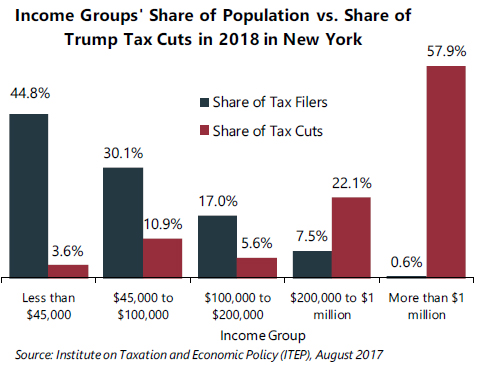

In New York 57 9 Percent Of Trump S Proposed Tax Cuts Go To People Making More Than 1 Million Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Who Can Take The New Business Tax Deduction Even Tax Experts Aren T Sure Utica New York Emotional Wellness National Sleep Foundation

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Feds Raise The Tax Bar Higher For Ny Empire Center For Public Policy

Budget For Family Of Three Retiring Early Off 5 Million Early Retirement 10 Million Dollars Retirement